Running a Muay Thai gym in the states is a labor of love. That being said, Muay Thai is growing stateside and internationally. Gym owners can make a great living doing what they love–as long as they take the time and effort to strategically plan, invest, and grow their business.

The vast majority of gym owners get into gym ownership for one–or both–of two reasons:

- They love Muay Thai and want to create a lifestyle and place where they can continue to center their lives around the sport;

- They are aging out of fighting and trying to figure out what to do next.

While these are both valid and noble reasons for opening and operating a gym, they do not always translate to long term business success. Being skilled in your craft and loving what you do are only two of the many inputs needed to running a successful business. Below we will review six basic business rules of thumb that can help any gym owner run a tighter, more profitable business, and earn a solid living doing what they love.

1. Don’t Avoid the Numbers

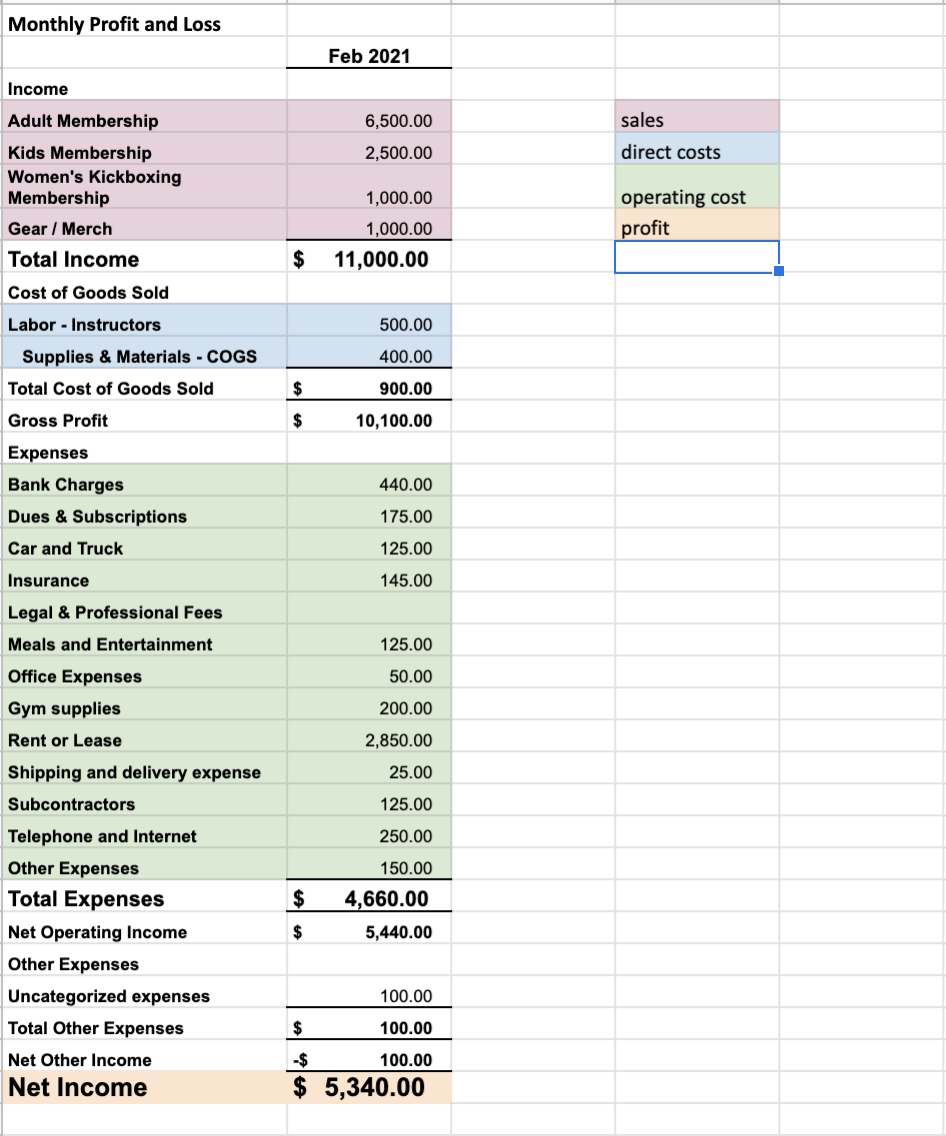

Passing off the bookkeeping and accounting to an accountant or bookkeeping firm is OK, and sometimes the right move; however, every business owner should have a basic understanding of business and financial statements. At the core of it, business owners must understand a profit and loss (P&L) statement.

At the top of the P&L, there is sales (also known as revenue), which is the money coming in the door. Monthly memberships make up the primary revenue stream for U.S. Muay Thai gyms, but merchandise sales, private lessons, gear sales, and drop in fees may constitute a sizable chunk of your monthly sales as well.

Subtracted from the total sales are all of the direct and indirect expenses associated with running a gym. These typically include things such as rent, instructor pay, utilities, equipment and gear purchases, automobile and gas expenses, etc. What is left over is referred to as the profit, or money left in the bank account. See below for a simple example of a P&L Statement.

Remember: Total Sales – Direct Expenses – Indirect expenses = Profit

By understanding how to read a P&L and create financial projections, business owners can map out a plan on how to build a business that meets their financial goals. Based on the legal structure of the business–sole proprietorship vs. corporation vs. LLC etc– P&Ls may look a bit different, but by understanding the basics you will be able to make business decisions based on data, and map out future business goals based on concrete evidence.

2. Keep Three Months of Operating Expenses in the Warchest

The small business rule of thumb is to have access to three months of expenses in case of a rainy day–i.e. a global pandemic that shuts everything down.

So, if rent, utilities, software fees, etc. come out to $5,000 a month, the business bank account–or line of credit account–should always stay above $15,000. While this sounds extreme to some, small businesses fall victim to the whim of the world. A wildly successful business that mishandles their money can easily run into serious issues if something like a flood, fire, or pandemic halts their operations.

Before I paid myself a dime out of the business, I worked two jobs and reinvested business profits into building a strong operating account. When the pandemic hit, we were able to pivot and regroup without having to scramble for next month’s expenses.

3.Diversify Your Revenue Stream

We all love training fighters. It’s our passion and it brings immense joy to see a student get their hand raised in the ring. However, with fighters come all the associated costs of traveling, hotels, corner fees, and most importantly, time. Simply put, very rarely do fighters alone pay the bills.

Understand the needs of your community. Is the gym located in the suburbs with a ton of families who are looking to instill grit and confidence in their kids? Is the gym located in a young urban center, where the owner can market a Women’s Kickboxing program or create a Muay Thai program at a university that translated to inbound customers at the gym?

The less diversified a business, the higher risk it runs of insolvency. Even if a gym only markets a ‘Muay Thai program’, there should be some sort of offerings or distinctions that allow for multiple types of folks to train and become invested in the space and community. A business with multiple revenue streams has a wider customer base and runs less risk of putting all their eggs in a single basket.

4. Pay Your Staff!

This one may seem counterintuitive, but I believe it to be true.

Yes, most gyms can find loyal fighters who will teach classes or hold intro lessons for a comped membership. However, by paying staff, owners set clear expectations based on an hourly transaction. I’ve found that this leads to a more invested and dedicated staff. The instructors understand their worth and take pride in something they are earning a wage off of. The quality is higher, the expectations clearer, and the outcomes by in large, superior.

As the business owner, it’s a lot easier to hold someone to high standards if you are compensating them.

5. Understand the Concept of a ‘Fixed Expense’ Business

The majority of gym expenses are fixed. Meaning, they do not increase as the customers–or total sales–increase. Rent is the same whether five or twenty people take class. Utilities stay roughly the same. The monthly software fees stay about the same as do the phone bills, car payments, internet bills, and property taxes.

Know how many monthly memberships it takes to cover business expenses, how many it takes to cover business and personal expenses, and how many it takes to hit your ideal salary goal.

If it takes 55 monthly memberships to hit break even, every membership after that is essentially cash in the business’ pocket. Of course additional instructors may need to be hired, or equipment purchased more regularly, but these costs are relatively small as a percentage of each new membership. It’s a numbers game and you need to know these numbers.

6. Map Out Your Goals in a Strategic Plan

Small businesses routinely and consistently grow themselves out of business.

The business organically grows, new opportunities, larger spaces, fancy new equipment present themselves and suddenly–poof–the once strong profit margin disappears.

To avoid this, owners need a clear strategic end goal. I believe that three things must be thought out ahead of time:

- The wage a business owner wants to make;

- The average time an owner wants to work on a weekly basis;

- The extent the business should grow.

An owner who wants a single, small physical location, packed with fighters, should run a very different business model then an entrepreneur looking to open multiple locations and take home a six-figure salary.

As a bookkeeper and small business advisor, I ask people about their short and long term goals and then work backwards to create a strategic plan and financial projections. By knowing your end goal, you are able to work backwards to establish the proper gameplan.

Conclusion

Juniper Muay Thai survived the pandemic and turned a half decent profit in 2020.We were cash positive by month three. On our year first anniversary, we were making two middle class incomes doing what we loved.

Very few get rich off of a Muay Thai gym, but very many can earn a solid middle class lifestyle doing the thing they love most. Assuming the Muay Thai knowledge and background is there, and the quality of instruction is high, it simply boils down to a core business knowledge set and vision.

- Can the business owner read and analyze their financial statements?

- Does the business owner have a clear vision of what they want their business to be?

- Are business decisions made based on financial data and objective facts?

Making business decisions based off of targeted strategy and clear financial data will allow a gym owners to earn a better living with less stress, and thus focus more on the thing they love to do most–coaching and teaching.

George Pitsakis co-owns and operates Juniper Muay Thai Gym in South Philadelphia, USA. He also operates as a bookkeeper and small business advisor for a wide variety of small businesses.